Last week at EntStrategyGuy HQ was incredibly productive, marked by a significant surge in new subscribers and readership. This growth is attributed to the continuation of the 2023 Streaming Viewership Recap series, analyzing the number of hit shows debuting last year and identifying the winners and losers in the streaming landscape. Your support is greatly appreciated, and to keep these in-depth analyses coming, please subscribe!

This week’s double issue is packed with crucial streaming ratings updates, covering a wide range of topics from Netflix’s 3 Body Problem and Max’s Quiet on Set to Prime Video’s Road House and the ongoing competition in film release data. We’ll also delve into the new seasons of Netflix favorites Is It Cake? and Gabby’s Dollhouse, alongside an examination of notable TV show flops. Furthermore, we’ll explore the intriguing case of Family Guy, and other Seth MacFarlane animated sitcoms, gaining traction in streaming viewership.

Let’s dive straight into the data-rich world of streaming entertainment.

(Note: This streaming ratings report focuses on the U.S. market, utilizing data from Nielsen’s weekly top ten viewership ranks, Showlabs, TV Time trend data, Samba TV household viewership, company datecdotes, Netflix hours viewed data, Google Trends, and IMDb to pinpoint the most popular content. Data is current, with Nielsen’s data spanning from March 18th to March 31st.)

The Data Landscape Evolves: Welcome Luminate

Exciting developments are underway in streaming data! As previously discussed in detail, Luminate has begun releasing public data over the past two weeks.

More data, especially good data, is always beneficial for comprehensive analysis. Luminate’s data appears promising. They release two weekly top ten lists – one for original TV series and another for streaming original films – using a defined methodology. Crucially, Luminate provides “volume” metrics, such as total hours viewed or unique viewers, in addition to rankings. This quantitative approach offers magnitude alongside direction, enhancing our understanding of viewership, as previously highlighted.

Integrating Luminate’s data into regular analyses is planned, expanding our data sources to four quality providers. Three of these sources will cover all major streamers, and three will offer concrete numbers.

While eager to debut this data immediately, two factors necessitate a brief delay:

- Firstly, concerns regarding potential exclusivity issues with Variety, as previously mentioned, are being addressed. Luminate has reached out, and resolution is anticipated soon.

- Secondly, a new dataset requires sufficient data points to establish meaningful context. Therefore, analysis will commence after accumulating approximately eight weeks of Luminate data.

For now, consider this an exciting introduction to Luminate as a new data source. Expect in-depth insights in the coming weeks.

Television Viewership Shifts: Nielsen’s Acquired Charts and the Rise of Family Guy

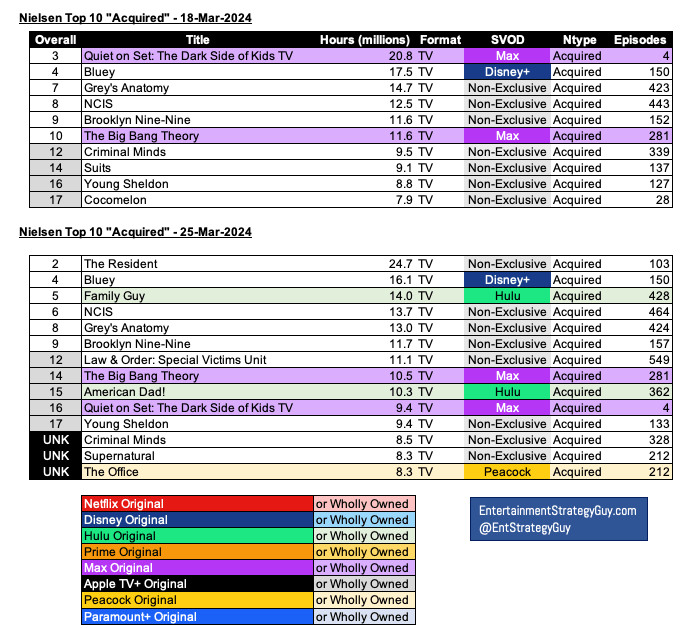

Analyzing Nielsen’s acquired charts from the last two weeks reveals a significant change, immediately apparent through color-coding:

Nielsen is now tracking a broader range of TV series. Notably, Seth MacFarlane’s animated sitcoms, American Dad! and Family Guy, have entered Nielsen’s top ten list for the first time. Law & Order: SVU, a show with infrequent chart appearances, also features. This inclusion of Family Guy in the streaming rankings highlights the enduring popularity of animated sitcoms in the on-demand era.

The reason for this shift, as explained by Nielsen in their press release, involves prior business agreements and technical measurement complexities.

Due to business agreements which preceded the rankings, coupled with the associated technical aspects of measurement, a subset of programs have been previously unavailable for external reporting. The SCR product enhancement has addressed these areas, significantly increasing the breadth of programs reported. All affected programs fall into the acquired category, having been primarily available on Hulu and/or Peacock after airing on a given linear network….prior to this enhancement, only a very small percentage of programs would have achieved Top 10 status

Essentially, Nielsen faced technical hurdles in differentiating between streaming and linear airings of frequently rerun shows. These issues, coupled with studio agreements regarding public disclosure, previously limited reporting on certain programs. These obstacles have now been overcome, which is a positive development for industry transparency.

Similar to the introduction of Luminate data, trend analysis from this Nielsen change will require several weeks of data collection. However, initial observations on the acquired charts from the past two weeks are insightful.

(The remainder of this article is for paid subscribers of the Entertainment Strategy Guy. To access the full analysis and support this work, please subscribe.

Your support is crucial to sustain this in-depth reporting. To understand the value of a subscription, explore these posts detailing the Streaming Ratings Report, its importance, benefits, and comprehensive coverage.

Like this:

Like Loading…