The landscape of healthcare in the United States experienced a significant shift with the introduction of the Affordable Care Act (ACA) in 2010. A key provision of this act allowed adult children to remain on their parents’ health insurance plans until the age of 26. Beyond providing affordable health coverage for young adults, this change created a unique financial planning opportunity, particularly for those covered under a parent’s High-Deductible Health Plan (HDHP). This situation enables these adult children to contribute to their own Health Savings Accounts (HSAs) up to the full family maximum contribution limit, which was $7,300 in 2022. This article delves into how families can leverage Adult Child Hsa Family Contribution strategies to maximize tax-advantaged healthcare savings.

Health Savings Accounts (HSAs) stand out as powerful savings tools due to their exceptional triple-tax benefits. Contributions are tax-deductible, growth within the account is tax-deferred, and withdrawals for qualified healthcare expenses are tax-free. It’s important to note that withdrawing HSA funds for non-qualified expenses before age 65 incurs a 20% penalty, in addition to being taxed as ordinary income. However, after age 65, the penalty is waived, and while withdrawals for non-medical expenses are still taxed as ordinary income, the flexibility increases significantly.

The IRS sets specific criteria for HSA eligibility. To contribute, an individual must be covered by an HDHP, lack other non-HDHP health coverage (with some exceptions), not be enrolled in Medicare, and crucially, not be claimed as a dependent on someone else’s tax return. Interestingly, HSA eligibility isn’t tied to being the primary policyholder. This opens the door for adult children covered under their parents’ HDHP who are not tax dependents to contribute to their own HSAs. Furthermore, unlike spouses who share a family contribution limit, non-dependent children covered under the same family HDHP can each contribute up to the full family maximum to their individual HSAs.

Before diving into HSA contributions, families must assess whether an HDHP is the right choice, considering their healthcare needs and financial situation. Financial advisors play a crucial role here, helping clients weigh the tax advantages of HSAs against the higher deductibles typically associated with HDHPs compared to traditional plans.

Ultimately, the pivotal takeaway is this: the ACA’s provision allowing children to stay on parents’ plans until age 26, combined with HSA rules, creates an opportunity for non-dependent adult children under family HDHPs to contribute to their own HSAs. Given the substantial tax benefits HSAs offer, advisors can guide families in determining if a family HDHP strategy aligns with their overall financial well-being.

Unpacking HSA Eligibility for Adult Children on Family HDHPs

IRS Publication 969, “Health Savings Accounts and Other Tax-Favored Health Plans,” outlines the specific requirements for HSA contributions. These key eligibility criteria include:

- HDHP Coverage: You must be covered by a High-Deductible Health Plan (HDHP) on the first day of the month.

- No Other Health Coverage: You cannot have other non-HDHP health coverage (with certain exceptions like specific types of insurance).

- Not Enrolled in Medicare: You cannot be enrolled in Medicare.

- Not a Tax Dependent: You cannot be claimed as a dependent on someone else’s tax return. This is the critical element for adult child HSA family contribution strategies.

Notably absent from these requirements is the mandate that the individual must be the policyholder of their own health plan. This is the linchpin that enables multiple family members covered under someone else’s plan—such as adult children on a parent’s HDHP—to contribute the family maximum to their own HSAs. In 2022, this family maximum was $7,300, and it increased to $7,750 in 2023.

This distinction is crucial: HSA contribution limits are tied to the type of plan (individual or family HDHP), not individual status within the plan. Therefore, a non-dependent adult child on a family HDHP can contribute up to the family maximum to their HSA. It’s also important to understand that while married spouses on a family HDHP share the family maximum contribution limit (meaning their combined contributions cannot exceed the family maximum), non-dependent children can each contribute up to the full family maximum allowed by the HDHP. For individuals with individual HDHP coverage, the HSA contribution maximum was $3,650 in 2022, and family members cannot be covered under an individual HDHP for HSA contribution purposes.

Adding another layer of flexibility, similar to 529 plans or after-tax investment accounts, anyone can contribute to an eligible individual’s HSA. This means parents can directly contribute to their adult child’s HSA, potentially utilizing the annual gift tax exclusion, which was $16,000 per individual in 2022.

Example 1: Steve and Susan, a married couple, have two adult children: Chelsea (22), who is employed full-time and not a tax dependent, and Chad (20), an undergraduate student who is their tax dependent. The family is covered by a family HDHP.

Steve and Susan can jointly contribute up to $7,300 to their HSAs in 2022. This amount can be allocated between their accounts as they choose.

Because Chelsea is not a tax dependent, she can contribute $7,300 to her own HSA, regardless of her parents’ HSA contributions. Alternatively, Steve and Susan can contribute to Chelsea’s HSA, alongside their own, provided total contributions to Chelsea’s HSA do not exceed $7,300. Importantly, regardless of who makes the contributions, Chelsea can deduct the full amount on her tax return.

Chad, however, despite being covered by the family HDHP, is ineligible to contribute to an HSA because he is claimed as a tax dependent.

Nerd Note Author Avatar

Nerd Note Author Avatar

Nerd Note:

It is generally advantageous for individuals to fund their HSAs through payroll deductions whenever possible. Contributions made via payroll deduction are treated as pre-tax, reducing not only taxable income but also potentially avoiding payroll taxes (FICA taxes). Direct HSA contributions are income tax-deductible, but they don’t retroactively reduce payroll taxes already paid on the contributed funds.

Navigating Dependency Rules for Adult Child HSA Eligibility

A crucial aspect of adult child HSA family contribution planning hinges on dependency status. For an adult child to open and contribute to an HSA while on a parent’s HDHP, they must not be claimed as a tax dependent. It’s important to understand that eligibility isn’t just about whether parents actually claim the child, but whether they can claim them.

The IRS outlines five tests to determine if a child qualifies as a “qualifying child” dependent. All five must be met:

- Relationship Test: The child must be the taxpayer’s son, daughter, stepchild, foster child, or a descendant of any of them. Siblings, half-siblings, step-siblings, and their descendants also qualify.

- Age Test: As of December 31st of the tax year, the child must be under age 19, or under age 24 if a full-time student. There’s no age limit for permanently and totally disabled children. The child must also be younger than the taxpayer claiming them.

- Residency Test: The child must live with the parents for more than half the year. Temporary absences, such as for college, are considered living at home.

- Support Test: The child must not provide more than half of their own financial support for the year.

- Joint Return Test: The child cannot file a joint tax return with a spouse, unless it’s solely to claim a refund of withheld taxes.

Failing even one of these tests renders the child ineligible to be a “qualifying child” dependent, which is a key step towards HSA eligibility. The age test (children aged 24-26), residency test (not living with parents for more than half the year, excluding college), and support test can often be pivotal in determining non-dependent status.

Even if a child doesn’t qualify as a “qualifying child,” they might still be claimed as a dependent under the “qualifying relative” rules. This is particularly relevant for children aged 19 or older who are not full-time students but may still rely on parental support. The tests for a “qualifying relative” dependent are:

- Gross Income Test: The child’s gross income must be less than $4,400 for 2022.

- Support Test: Parents must provide more than half of the child’s total support during the year.

The “qualifying relative” designation is most common when an adult child is not a full-time student and earns a modest income, still relying on significant parental support.

Nerd Note Author Avatar

Nerd Note Author Avatar

Nerd Note:

The simplified explanation of “qualifying relative” dependency focuses on children who don’t meet “qualifying child” criteria. However, there are actually four tests for “qualifying relative” status. Beyond the Gross Income and Support tests, the person cannot be a “qualifying child” and must also either live with the taxpayer all year as a member of the household or be related to the taxpayer in specific ways outlined by the IRS.

Based on these dependency rules, here are examples of adult children who cannot be claimed as dependents and would be eligible to open their own HSAs while covered under their parents’ HDHP:

- George, 18, lives at home but works full-time and covers all his own expenses, including rent paid to his parents. [George is neither a qualifying child nor a qualifying relative because he provides more than half of his own support through rent and living expenses.]

- Angela, 20, lives at home and works part-time, earning $8,500 annually. Her parents provide the majority of her support. [Angela is not a qualifying child due to her age and student status. She is also not a qualifying relative because her income exceeds $4,400.]

As highlighted, the support test is a key factor in determining dependency. Parents can even strategically gift funds to their adult children, up to the annual gift exclusion amount ($16,000 per recipient in 2022), to help them cover their own living expenses. Gifts are generally considered the child’s own funds for support purposes, not parental contributions.

College expenses, however, can complicate the support calculation. Tuition paid directly by parents is considered support. If parental tuition payments exceed half of the child’s total support (including living expenses), the child may still be considered a dependent, even if they cover their daily living costs through employment.

Conversely, if parents gift funds to their child, and the child uses those funds to pay tuition, this can shift the support calculation. Gifts directly to the child, even if used for tuition, can be considered the child’s own support contribution. Therefore, strategic gifting can be a tool to help adult children achieve non-dependent status and HSA eligibility.

Gift Tax Implications of Parental HSA Contributions

While individual gifts are generally subject to federal gift tax, the annual gift tax exclusion allows individuals to gift up to $16,000 per recipient in 2022 (and $17,000 in 2023) without incurring gift tax. This exclusion applies to an unlimited number of recipients annually (excluding spouses, as gifts to spouses are generally not taxable).

It’s important to distinguish that while direct payments of medical expenses for another person are typically exempt from gift tax, contributions to someone else’s HSA are not considered exempt medical expenses. Instead, HSA contributions are treated as taxable gifts. However, in most cases, parental contributions to an adult child’s HSA will fall under the annual gift tax exclusion and will not result in gift tax liability. These contributions are considered gifts, not deductible medical expenses for the parents.

HDHP Choices and HSA Eligibility: A Family Healthcare Strategy

Choosing the right healthcare plan is a complex decision for families. Factors like expected healthcare costs, deductibles, and premiums are crucial. However, for families with eligible adult children, the availability of an HSA through an HDHP adds another significant dimension to the decision-making process. The ability for children to remain on parents’ plans until age 26 makes HDHPs increasingly attractive for families with young adults still at home.

The Long-Term Power of HSAs for Young Adults

HSAs offer a unique triple tax advantage: tax-deductible contributions, tax-deferred growth, and tax-free withdrawals for qualified medical expenses. This is more advantageous than most retirement accounts, which typically offer only two of these benefits. This triple tax benefit makes HSAs exceptionally attractive for those eligible.

In return for these tax advantages, HSAs have specific rules and penalties. While qualified medical expense withdrawals are always tax-free, non-qualified withdrawals are taxed as ordinary income. Withdrawals for non-qualified expenses before age 65 also incur a 20% penalty. After age 65, the penalty is waived, and withdrawals are taxed as ordinary income if not used for qualified medical expenses, similar to traditional IRAs.

The ACA provision extending dependent coverage to age 26 significantly enhances the value of HSAs for young adults. Adult children who might not have previously had access to an HDHP, or any health insurance at all, can now participate in their parents’ family HDHP. This allows them to contribute to an HSA up to the family maximum for an extended period—potentially six or more additional years (from age 19 under previous rules to age 26). This extended contribution window is powerful because it allows for both the immediate tax deduction on contributions and decades of tax-deferred growth.

Given the projected rise in healthcare costs, especially in retirement, early HSA adoption and consistent contributions are crucial. HSAs can become dedicated “retirement healthcare” savings accounts. For adult children who maximize HSA contributions annually, the tax-advantaged growth potential over time, especially with coverage until age 26, is substantial.

HSAs are particularly powerful when invested in equities and allowed to grow long-term, mirroring Roth account strategies. The “triple-tax-free” nature of HSAs (if used for qualified medical expenses) makes this long-term growth strategy highly effective.

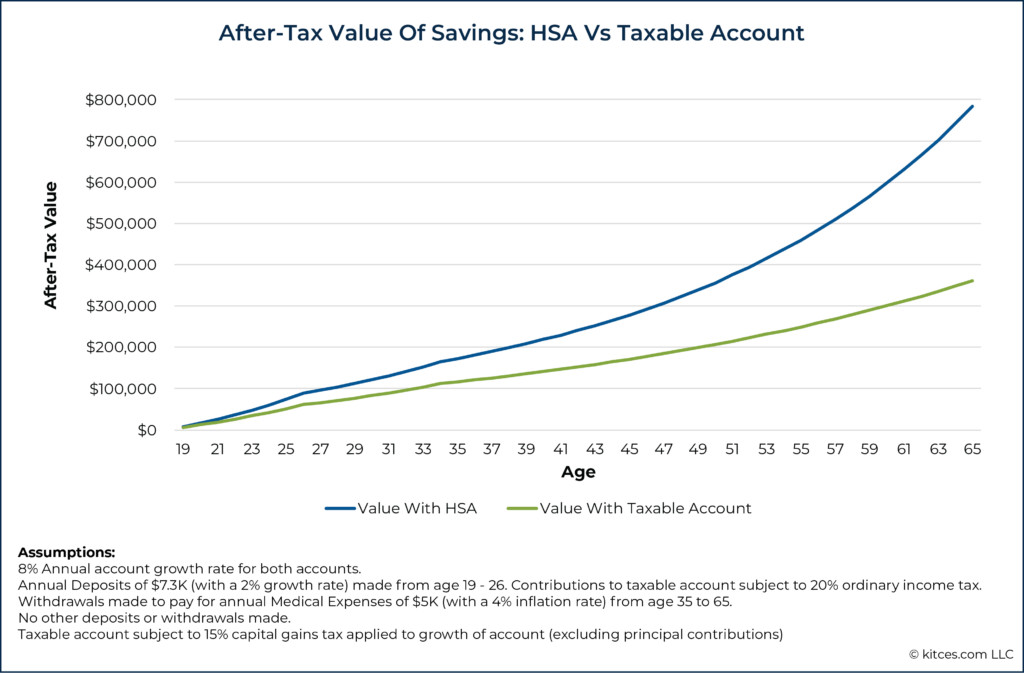

The illustration below demonstrates the significant difference in after-tax value between an HSA and a taxable account for a young adult contributing the maximum HSA amount from age 19 to 26, with projected medical expenses from age 35 to 65.

After Tax Value Of Savings

After Tax Value Of Savings

Caption: Comparison of After-Tax Savings Value in HSA vs. Taxable Account Over Time

Young adults, typically healthier and with lower medical expenses, are ideally positioned to maximize HSA savings. By contributing the maximum early and allowing the funds to grow, they can accumulate significant balances by age 26, and potentially hundreds of thousands by retirement, creating a substantial fund for future healthcare needs.

Example 2: Dawn, 19, is covered by her parents’ HDHP and is not a tax dependent. She opens her own HSA.

With parental support, Dawn contributes $7,300 annually to her HSA for seven years, until she ages out of her parents’ plan at 26.

Assuming a 6% annual investment return, Dawn could have approximately $61,275 by age 25.

If she ceases contributions and allows the funds to grow until age 65, her balance could reach nearly $594,600 (at the same 6% return). This substantial sum would be available penalty-free after age 65 for any purpose and tax-free for qualified medical expenses at any age.

When Family HDHPs with Adult Children Make Financial Sense

The tax-deductible HSA contributions linked to HDHP coverage are a major advantage. The upfront tax deduction, tax-deferred growth, and tax-free withdrawals can significantly shift the healthcare plan decision in favor of HDHPs, especially for healthy families and when multiple family members can contribute to HSAs.

Example 3: Mary and Steve have a 19-year-old daughter, Wendy. The entire family is on an HDHP through Mary and Steve’s employer.

Wendy, now employed full-time and self-supporting, chooses to stay on her parents’ HDHP because her employer doesn’t offer HDHP coverage, and she wants to leverage an HSA. She contributes $5,000 to her HSA, and her parents gift her an additional $2,300 to reach the $7,300 maximum.

Mary and Steve also maximize their HSA contributions via payroll deduction, each contributing $3,650 ($7,300 total).

On their tax returns, Wendy can deduct $7,300 for her HSA contributions, and Mary and Steve can deduct $7,300 for their combined HSA contributions.

However, healthcare costs and plan structures vary widely. The common plan choices are HDHPs and Preferred Provider Organizations (PPOs), which typically have lower deductibles but higher premiums.

HDHPs generally have higher deductibles, lower premiums, and higher out-of-pocket maximums, while PPOs have lower deductibles, higher premiums, and lower out-of-pocket maximums. HDHPs often offer greater provider flexibility, while PPOs may have narrower networks.

While HDHPs are attractive for healthy individuals seeking HSA benefits, they aren’t universally the best choice. Individuals with significant expected medical expenses may benefit more from PPOs with lower out-of-pocket costs. However, for those who can maximize HSA contributions, the tax savings can offset the higher deductibles of an HDHP.

Example 4: Jack and Morgan, in the 22% tax bracket, have three dependent children and a combined income of $250,000. They anticipate $20,000 in annual healthcare costs and are comparing plan options.

Jack’s employer offers a family PPO with no deductible and a $10,704 annual premium. Morgan’s employer offers a family HDHP with a $6,000 deductible and $5,000 annual premium, resulting in a maximum annual cost of $11,000.

The HDHP allows for a $7,300 HSA contribution, generating a federal tax deduction of $1,606 ($7,300 x 22%). This reduces the net HDHP cost to $9,394 ($11,000 – $1,606).

In this scenario, the HDHP becomes the more cost-effective option due to the HSA tax savings, despite the higher initial cost.

Choosing between plans requires careful consideration of premiums, deductibles, expected healthcare costs, and potential HSA tax savings. Advisors should take a holistic approach, considering a client’s health status, family history, and financial situation to recommend the optimal healthcare strategy.

Implementing HSA Strategies for Families

Opening an HSA is straightforward. Advisors can assist clients in opening accounts or provide guidance for self-enrollment through various online providers.

Key factors for advisors to consider when recommending HSA providers include:

- Annual Fees: Many HSAs now offer no annual fees.

- Minimum Contributions: Some may have minimum initial contributions.

- Investment Minimums: Some require a cash balance minimum for investment access.

- Investment Options: A robust investment menu is crucial for long-term HSA growth.

Providers like Fidelity and Lively offer fee-competitive HSA options with investment capabilities. Fidelity HSAs have no fees or minimums and offer both self-directed brokerage and managed account options. Lively HSAs also have no monthly fees and offer self-directed and guided portfolio options.

Identifying Clients for Adult Child HSA Strategies

Advisors can leverage CRM systems to identify clients with children aged 18-25, potential candidates for adult child HSA family contribution strategies. Inquiring about healthcare coverage for clients with HDHPs and HSA eligibility is also essential. Scenarios to consider include:

- Gifting funds to adult children on their own HDHPs to maximize HSA contributions.

- Enrolling non-dependent adult children without HDHP coverage onto parents’ HDHP for HSA access.

- Strategically gifting funds to adult children to help them become non-dependents and then adding them to the family HDHP for HSA eligibility.

Proactively discussing healthcare plans and dependency status during client meetings and reviewing client balance sheets for existing HSAs can further identify opportunities. It’s critical to educate clients on the nuances of dependency rules and HSA eligibility. High-net-worth clients may have adult children who remain dependents longer due to full-time student status or significant parental support. Understanding these nuances ensures accurate HSA planning.

By identifying eligible families and proactively engaging both parents and adult children, advisors can deliver significant value, strengthening client relationships and fostering multi-generational financial planning.

Determining HDHP Suitability for HSA Optimization

Advisors should evaluate if a family HDHP is accessible, assess premiums and deductibles for HDHP and PPO options, and understand the family’s typical and anticipated medical expenses. This comprehensive analysis allows for an informed comparison of healthcare plan strategies.

Quantifying plan costs and potential HSA tax savings is crucial for informed decision-making. Estimating annual medical spending and considering the client’s and child’s tax brackets are vital for assessing the long-term impact of HSA strategies.

For clients already saving in taxable accounts or consistently exceeding the HSA contribution maximum in healthcare expenses, comparing HDHP costs (net of HSA tax savings) against PPO options provides a clear picture of the financial benefits of an HSA-driven approach.

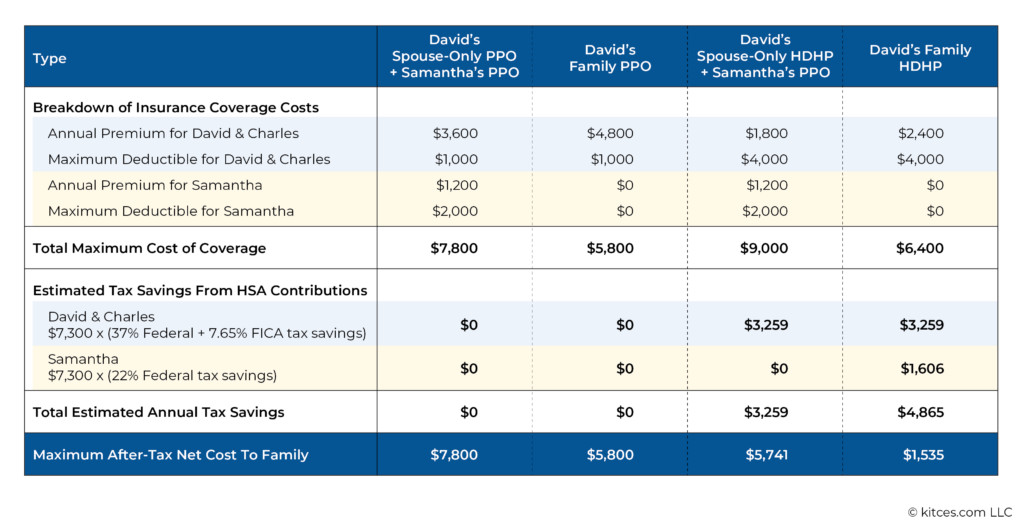

Example 5: David, in the 37% federal tax bracket, and his spouse Charles have a non-dependent 21-year-old daughter, Samantha. David has PPO and HDHP options through his employer, both with spouse-only and family coverage tiers. Samantha also has a PPO option through her employer. The family prioritizes cost-effective healthcare.

Plan Options:

- David’s PPO ( $1,000 Deductible)

- Spouse-Only: $300/month premium

- Family: $400/month premium

- David’s HDHP ($4,000 Deductible)

- Spouse-Only: $150/month premium

- Family: $200/month premium

- Samantha’s PPO ($2,000 Deductible)

- Individual: $100/month premium

The family analyzed after-tax net costs for different plan combinations, considering HSA tax savings and FICA tax savings for payroll deductions.

Maximum After Tax Net Cost To Family

Maximum After Tax Net Cost To Family

Caption: Comparison of Maximum After-Tax Net Cost to Family Across Different Healthcare Plan Options

Initially, David’s Family PPO seemed cheapest. However, factoring in HSA tax savings with the Family HDHP revealed it as the most cost-effective option.

It’s crucial to note that maximizing HSA contributions is key to realizing the full financial advantage of HDHPs. If HSA contributions are not maximized, the net cost of an HDHP can increase relative to a PPO. In Example 5, if Samantha didn’t contribute to an HSA and David and Charles only contributed minimally, the HSA tax savings would be reduced, potentially making the PPO a more financially sound choice. Therefore, assessing intended HSA contribution levels is crucial for accurate plan comparisons.

The ACA’s extension of dependent coverage to age 26, combined with HSA benefits, creates valuable tax planning opportunities for families with non-dependent adult children. HSAs, with their triple tax advantages, can significantly influence healthcare plan decisions, especially when multiple family members can benefit from HDHP coverage and individual HSA contributions.

Quality? Nerdy? Relevant?

We really do use your feedback to shape our future content!

Quality? Nerdy? Relevant?

We really do use your feedback to shape our future content!

[ ](